CBRE | COVID-19 WEIGHS HEAVILY ON Q2 COMMERCIAL REAL ESTATE INVESTMENT

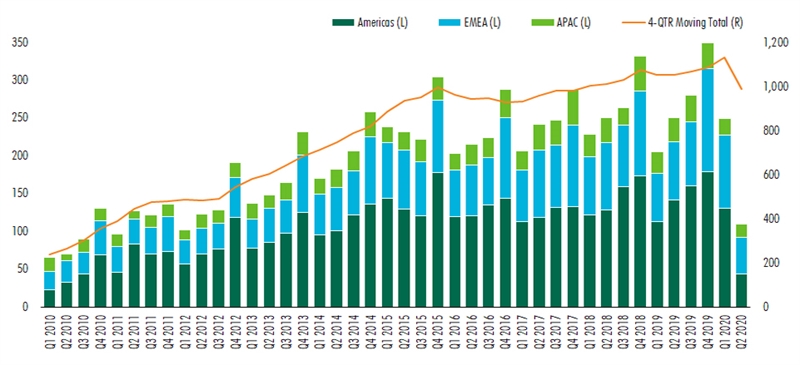

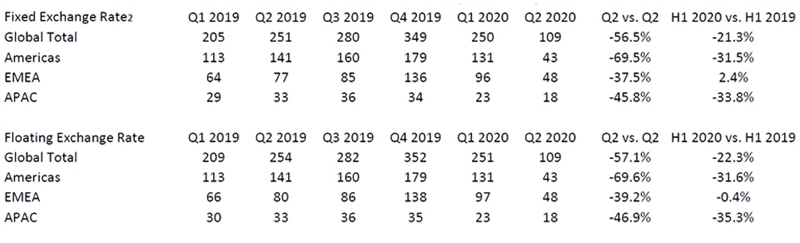

| Much weaker global CRE transaction volumes in Q2 2020 reflect the impact of lockdown measures and border controls enacted due to COVID. Global transactions totalled $109 billion, a 57% decline from the same period of last year, and the lowest quarterly total since 2010. The Americas region was hit the hardest, with a 70% year-over-year decline mainly due to pullbacks of large accounts including portfolio and entity-level transactions. EMEA and APAC reported a 38% and 46% decline, respectively, as uncertainty and restrictions hampered investor sentiment. The strength of Q1 led to a relatively moderate 21% contraction of investment volume in H1 2020. Q2 2020 marks the low point and as countries re-open and business activity resumes, investors look towards H2 2020 for a gradual recovery. | ||

Figure 1: Global Commercial Real Estate Investment Source: CBRE Research, RCA (Americas), Q2 2020. Source: CBRE Research, RCA (Americas), Q2 2020. | ||

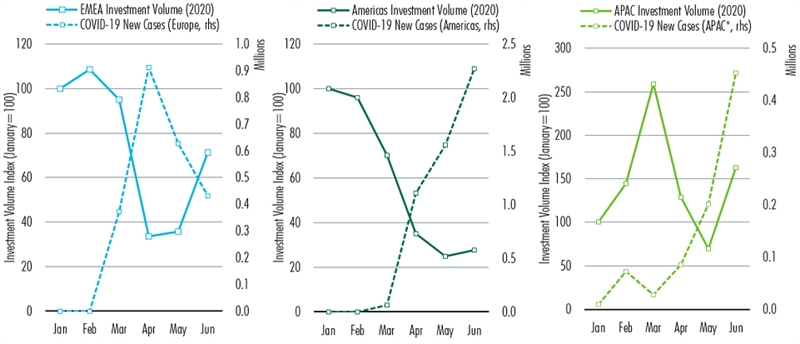

| Americas investment volume fell to $43 billion in Q2, the lowest level since 2010 and a fraction (30%) of the quarterly volume one year ago. The U.S. market made up 93% of the region’s investment activity. Key features of the data were a 77% decline in portfolio sales and the absence of entity-level transactions. Industrial asset sales demonstrated resilience despite contracting 50% in investment volume in Q2. The two Prologis M&A deals in Q1 pushed industrial investment up 17% in H1 2020 year-over-year. Excluding the two Prologis transactions, industrial investment declined 18% in H1 2020, still outperforming all other sectors in the same period. Retail assets did not fare much worse than other sectors, as Q2 volumes declined 74% year-over-year, on par with 72% declines in both office and apartment sectors. Hotel assets were the most severely impacted, showing a 90% decline and the lowest quarterly total since 2003. The city level decline in investment activity seems correlated with the level of COVID-19 development (Figure 2). Cities suffering from the worst infection rates, such as Seattle (-84%1), Orlando (-81%), Los Angeles (-80%), and New York (-71%), saw the steepest investment contraction in Q2. The continued surge of COVID-19 cases in the U.S., Brazil, and parts of Latin America will hinder the rebound of investor activity in those areas. As testing, tracking and treatment capacities grow, and confidence improves, H2 is expected to be stronger. Increased clarity on pricing and the rental outlook will also tempt discount-seeking investors to re-enter the market. EMEA investment volume totalled $48 billion in Q2 2020 and decreased 38% year-over-year. This result beat expectations and significantly outperformed other regions, accounting for 44% of global investment volume in Q2 (relative to an average share of 33% over the past five years). EMEA’s slump in Q2 was fully offset by a record Q1 this year, producing a 2% growth in H1 from the same period of last year. Contributing to the growth were mega-deals in Germany especially in multifamily, the U.K. and the Nordics. | ||

Figure 2: Investment Recovery Relies on Effective COVID-19 Control  Note: Asia (of APAC) as defined here includes Cambodia, China, Guam, Hong Kong, India, Indonesia, Japan, Malaysia, Maldives, Philippines, Singapore, South Korea, Taiwan, Thailand, Uzbekistan and Vietnam.Source: CBRE Research, RCA (Americas), European Centre for Disease Control, Q2 2020. Note: Asia (of APAC) as defined here includes Cambodia, China, Guam, Hong Kong, India, Indonesia, Japan, Malaysia, Maldives, Philippines, Singapore, South Korea, Taiwan, Thailand, Uzbekistan and Vietnam.Source: CBRE Research, RCA (Americas), European Centre for Disease Control, Q2 2020. | ||

| Uncertainty around COVID will continue to subdue investment in 2020 but signs of recovery were confirmed in June. Industrial (-34%) and multifamily (-29%) sectors remained attractive with core industrial yields reaching record lows. Value-add office assets are vulnerable to re-pricing. Retail investment surprised on the upside with a small decrease of 23% in Q2 year-over-year, driven by large-ticket deals in Germany and France. Hotel investment fell 83% to the lowest quarterly volume in nearly a decade. Germany (-20%), Netherlands (-23%), and Poland (-22%) saw relatively modest declines in Q2 year-over-year compared to the rest of Europe. Switzerland (174%) bucked the trend and nearly doubled the volume in the previous Q2, particularly because Thailand’s Central Group and Austrian Signa completed the acquisition of Globus, a Swiss department store chain. On the other hand, the U.K. (-56%), France (-57%) and Sweden (-45%) were hit hard by the pandemic and registered sharp declines in Q2’s investment. As Europe moves ahead with staged reopening, further rebound in H2 is expected. APAC deal volume fell by 46% year-over-year, totalling nearly $18 billion in Q2, the lowest quarterly total since 2012. The resurgence of COVID-19 cases in China, Japan, and Australia, and the ongoing “first wave” in India raised concerns over the region’s economic outlook and elongated the recovery timeline of investment activity. Following the global trend, industrial assets were highly sought after, decreasing by only 17% in Q2 and by 8% in H1. But office, which took the lion’s share of 56% of all APAC transactions, fell sharply by 46%. Investors turned to smaller deals or partial stakes in highly priced office buildings. Retail and hotel assets remained under pressure, reporting the lowest quarterly totals since the Great Financial Crisis. However, retail assets with residential catchments received improved interest. In the Pacific, domestic investors showed appetite for big-box retail assets with long-leased supermarket tenants. Among the three regions, APAC experienced the least quarter-over-quarter decrease of 23% in Q2. Sizeable deals in Australia (-21%) and South Korea (-36%) drove the activity rebound. Greater China 2 (-49%), Japan (-48%), and Singapore (-57%) fell behind for reduced activity in gateway markets like Tokyo and Beijing. While investors are more willing to re-enter the market, price discounts must be provided. CBRE’s full-year global investment forecast is slightly adjusted down from -32% to -38%, in light of recent sluggishness in the Americas pandemic control and economic recovery. A global rebound of activity is still expected to arrive before the end of year, given the general improvement in the ability to manage COVID-19. | ||

Figure 3: Total Value of Commercial Real Estate Investment Transactions (US$ Billions)1 Source: CBRE Research, RCA (Americas), Q2 2020. Source: CBRE Research, RCA (Americas), Q2 2020.1 Values include entity-level transactions and exclude development sites. 2 In order to calculate global totals, local currency values are converted to US$ using the most recent quarterly | ||

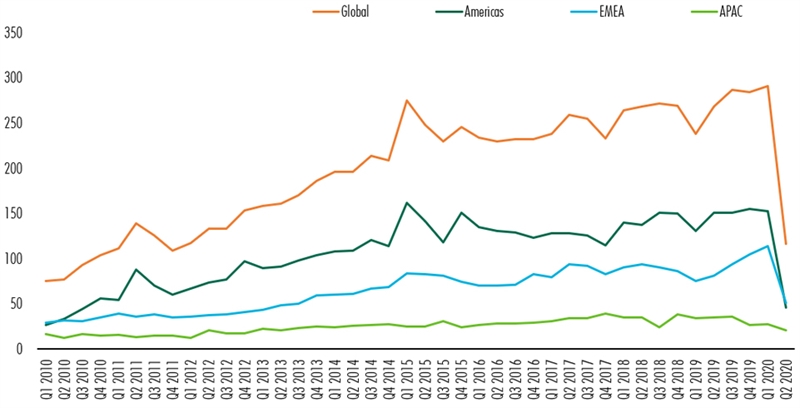

| Appendix The seasonally adjusted volumes are shown in Figure A1. These give a more accurate picture of transaction activity from quarter to quarter across any one year. | ||

Figure A1: Seasonally Adjusted Investment Volume (US$ Billions – Fixed FX) Source: CBRE Research, RCA (Americas), Q2 2020. Source: CBRE Research, RCA (Americas), Q2 2020. | ||

| 1 Year-over-year change in fixed exchange rate in Q2, unless otherwise noted. 2 Including Mainland China, Hong Kong and Taiwan. | ||